In recent years, the “long tail” has often been used to describe the current beer market. The term “long tail” first entered the parlance of our times via an article in Wired by Chris Anderson about the entertainment industry. In many ways the term seems like the perfect way to describe craft brewing. As Anderson writes, “most of us want more than just hits. Everyone’s taste departs from the mainstream somewhere, and the more we explore alternatives, the more we’re drawn to them.” While he was writing about music and movies, doesn’t this sound a lot like beer? Light American adjunct lagers were the hits, but beer lovers increasingly found themselves drawn to alternatives.

Beer Is Still a Physical Product

Nevertheless, I’ve always thought that using the term “long tail” to describe beer, at least in the way Anderson’s formulation originally intended, failed in a number of key ways. The most important divergence is the difference between an entertainment industry that has moved into the digital world, and a beer industry which is most definitely still rooted in physical products. Anderson highlighted that digital transmission had broken the “tyranny of space” that led to inefficient distribution in entertainment, equated popularity with profitability, and meant that niches were ignored. Digital technologies have shattered this world, as lowered costs of reproduction and transmission mean that the economics of scarcity no longer apply, there is big money in aggregating the smallest sales, and audiences are global rather than local.

That means that although digital technology made it easier than ever to find beer information, for the moment, beer distribution and retailing continue to still very much be shackled by the tyranny of physical space – there are only so many SKUs distributors are willing to carry, only so many taps and shelf placements allocated to beer, and only so much beer a local retailer is willing to stock in their store. Regulations also matter, and so a beer that you can buy in one state you can’t necessarily buy a few miles away across the border. In addition, beer is restrained by the limits of perishability – a digital movie stays fresh on Netflix’s server indefinitely, a double IPA does not. Although a megastore with every beer in the world sounds incredible in theory, in practice it would inevitably lead to out of date beer and a stock rotation nightmare. Finally, there is reproducibility. A song that goes viral can be downloaded by every American instantly. Beers are limited by the production capacity of the brewery that brews them.

This creates a tension where digital technology allows general consumer awareness of the long tail, but that awareness doesn’t necessarily translate into the ability to buy or sales. So, will beer ever get a market response akin to the distribution revolution seen in digital entertainment? Can technology match fresh beer with the right consumers in a world with ever proliferating brands? Or put differently, how much can the long tail in beer continue to grow in line with what has been seen in other parts of the economy like entertainment? How many brands is too many, and can technology increase that theoretical ceiling?

The Pandemic Is Both a Disruption and An Opportunity

I raise these questions because in this moment they are as relevant and timely as they have ever been. COVID-19 has disrupted normal selling channels, slashed the number of SKUs selling in broad distribution, while simultaneously accelerating e-commerce and opening up new channels for sale such as delivery or even direct-to-consumer. It’s also made Americans more aware than they have ever been that it might be possible to shop for beer in places other than the grocery store, liquor store, or their local brewery.

Awareness and ability, however, are two different animals. Part of what made the digital revolution possible in things like music were new platforms that helped users search, categorize, store, and purchase more easily. While we certainly have apps that let people search for beers and catalog what they like, there currently isn’t a beer equivalent of iTunes or Spotify where you can instantly buy and drink whatever beer pops into your head.

So what does the future look like for the long tail of beer? Will COVID-19 hurt by squeezing SKUs at distribution or retail, or will it help by unlocking demand for digital sales and pressuring lawmakers to adapt 1930s or 1970s laws to the digital age? Can beer move further into the world of online retailing?

Look at other products, even other beverage alcohol categories such as wine, and you see more progress. Across retail we’ve seen a slow but steady shift from “push” to “pull” retailing and matching digital platform innovation designed to help customers find the specific product they are looking for, rather than simply the selection that the retailer has to offer.

Beer has been slower to fully enter the “pull” era than many consumer goods. There are a number of reasons for this. Existing regulatory and distribution structures, the aforementioned freshness problems, and scale issues associated with physical goods all contribute. A specific retailer can only offer what is legally distributed in their area, and even within that selection they have limits based on shelf space, cooler space, tap handles, and stock levels relative to what they can realistically sell in a given time period.

Wine has a few advantages over beer in this regard. Many wines can store for years, making it easier for retailers to carry a wide selection and not worry about their inventory depreciating (depending on the type of wine, it might actually appreciate). The economics of wine also lend themselves better to shipping and delivery, as many wines have a value to weight ratio that works much better with shipping costs than beer. Finally, wine’s regulatory environment has generally been updated to better match the digital era. Much of this is geographic. Wineries are far more concentrated in particular states than breweries, both in numbers and in quality, and so have a greater incentive to change laws in favor of cross-border direct shipping.

That’s not to say that everything about wine is made for a “long tail” era. For one, wine suffers the same reproducibility problem as beer. Even if everyone really loved a particular wine, they aren’t making more of older wine vintages. However, wine is closer to the digital model of the long tail than beer. On Wine.com, I can quickly search and sort and find a variety of options that will show up at my door in a few days. Looking for even niche wines turns up numerous options. There are 47 California pinot noirs under $25 with 90+ ratings. Going beyond aggregator sites, I could likely buy directly from thousands of California wineries if I was willing to put in my own research.

So is it time for beer to enter this new era? What would it take and how might it look different, both in terms of platform, availability, and model? Would this be a good thing for beer and beer lovers? Right now I don’t think there are clear answers.

Beer E-Commerce Will Be Shaped by Consumer Demand and Politics

Many of the new digital platforms seem intent to reinforce current systems rather than engage in creative destruction. Delivery apps largely add a fourth tier rather than pushing on existing distribution systems. They make their money as much through advertising and promotion of existing market leaders as they do by leaning in on algorithms to help consumers find new products in the long tail.

In addition, for years, breweries have invested in a different form of direct-to-consumer and retail sales: taprooms and brewpubs. Brewery models have been built around getting beer lovers into their space, and then selling them beer, either onsite or to-go. As such, much of the innovation we’ve seen in the COVID-19 period has been additive to this model, rather than trending in the direction of wine. Breweries are adding more delivery and to-go options to existing POS systems. Some of this had gone on before COVID-19. Breweries released apps to help their customers find their small batch beers or used Twitter to keep fans informed on how many cases of popular beers were left. Why would these breweries then transfer those sales to a platform they don’t control or push for direct-to-consumer shipping, which is arguably a competing model for to-go sales.

The answer, as always, will depend heavily on consumer demand. Along with regulation (more on that in a second), this is likely going to be a powerful force that shapes the development of e-commerce in beer including its shape, retail channels, and size over the next few years. Consumer demand for particular breweries and their beers clearly exists, but how deep and widespread is that demand? Is it strong enough to shift the patterns of buying local that have predominated in recent years? Do beer drinkers want more choice or simply convenience and more efficient ways to buy?

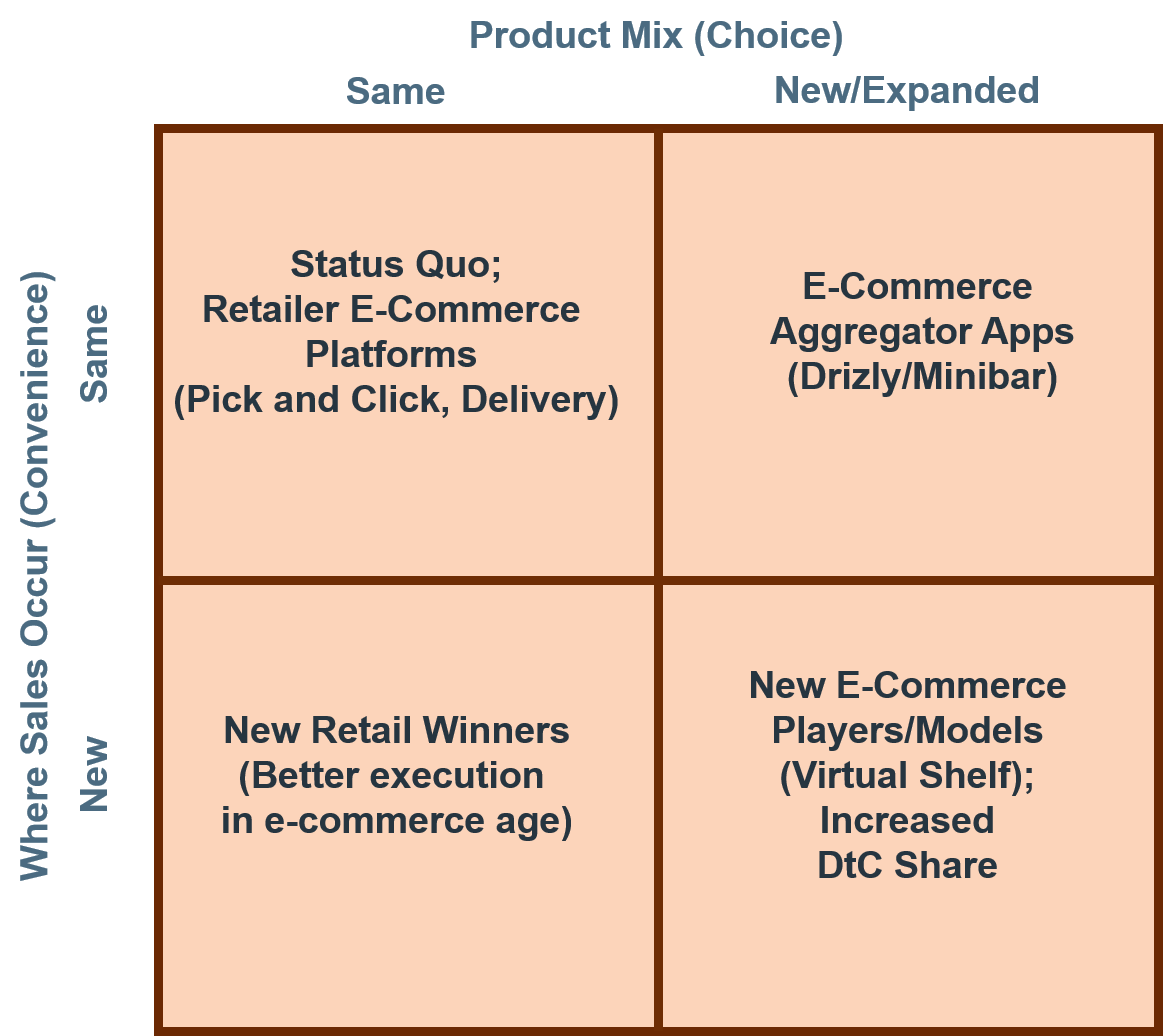

In turn, consumer demand will shape which platforms grow and who wins in the coming years. Even if I were to state definitively that e-commerce will grow strongly over the next few years, it’s hard to know what portion of the beer market that benefits without knowing what e-commerce channels are the ones that will grow. Will it be:

- Physical retailers adding e-commerce platforms (same products/same retailers)

- E-commerce retailers connecting to the physical world (new products/new retailers)

- E-commerce aggregator apps (new products/same retailers)

- Direct-to-consumer platforms that connect producers with consumers (shift from retailers to producers)

- New E-commerce models that don’t yet exist (at least at scale)

The answer is likely a combination, and that final balance of consumer preferences for more convenience versus more choice will be critical in picking winners and losers, on both the retail side and brewery side. Each of the options above represents a different balance of buying patterns, retailers, distribution, and product variety. Each also will require different corresponding shifts in distribution and retail to compete with the growing platforms in terms of product assortment.

As always, incumbent interests and regulation will also play a role. While I have focused more on the range of e-commerce possibilities and their match with consumer demand, in beverage alcohol consumer demand is always only one part of the equation. Political interests will also likely seek to conflate convenience and choice in future debates over market regulation. Just because you have an app that allows you to buy beer with a few clicks doesn’t mean consumers are fundamentally getting new options. How new channels are regulated and routed through existing channels will in turn shape consumer outcomes based on what is legally available. Even if consumers want more than just the hits, which indie beers they will be offered over the next decade will be decided by statehouses as much as by apps and their own preferences.

Resource Hub

Resource Hub